The Mit Blackjack Team. The MIT blackjack team has become famous worldwide for their success at beating the game of blackjack in the casinos of Las Vegas.Even people who are unfamiliar with blackjack and gambling know the story of the MIT students, thanks in large part to the popular movie 21. The MIT Blackjack Team was a group of students and ex-students from the Massachusetts Institute of Technology, Harvard University, and other leading colleges who used card counting techniques and more sophisticated strategies to beat casinos at blackjack worldwide. The team and its successors operated successfully from 1979 through the. Busting Vegas (stylized as Busting Vega$) is a 2005 book by Ben Mezrich about a group of MIT card counters and blackjack players commonly known as the MIT Blackjack Team.The subtitle of the original, hardcover edition was The MIT Whiz Kid Who Brought the Casinos to Their Knees, but the subtitle of the subsequent paperback editions was A True Story of Monumental Excess, Sex, Love, Violence,.

The MIT Blackjack Team was a group of students and ex-students from the Massachusetts Institute of Technology, Harvard University, and other leading colleges who used card counting techniques and more sophisticated strategies to beat casinos at blackjack worldwide. The team and its successors operated successfully from 1979 through the beginning of the 21st century. Many other blackjack teams have been formed around the world with the goal of beating the casinos.

Blackjack and card counting[edit]

Blackjack can be legally beaten by a skilled player. Beyond the basic strategy of when to hit and when to stand, individual players can use card counting, shuffle tracking, or hole carding to improve their odds. Since the early 1960s, a large number of card counting schemes have been published, and casinos have adjusted the rules of play in an attempt to counter the most popular methods. The idea behind all card counting is that, because a low card is usually bad and a high card usually good, and as cards already seen since the last shuffle cannot be at the top of the deck and thus drawn, the counter can determine the high and low cards that have already been played. They thus know the probability of getting a high card (10,J,Q,K,A) as compared to a low card (2,3,4,5,6). Free online poker no download with friends.

In 1979, six MIT students and residents of the Burton-Conner House at MIT taught themselves card-counting. They traveled to Atlantic City during the spring break to win their fortune. The group went their separate ways when most of them graduated in May of that year. Most never gambled again, but some of them maintained an avid interest in card counting and remained in Cambridge, Massachusetts. Two of them, J.P. Massar and Jonathan, offered a course on blackjack for MIT's January, 1980 Independent Activities Period (IAP), during which classes may be offered on almost any subject.

First MIT blackjack 'bank'[edit]

In late November 1979, Dave, a professional blackjack player contacted one of the card-counting students, J.P. Massar, after seeing a notice for the blackjack course. He proposed forming a new group to go to Atlantic City to take advantage of the New Jersey Casino Control Commission's recent ruling that made it illegal for the Atlantic City casinos to ban card counters. Casinos instead have to take other countermeasures like shuffling the cards earlier than normal, using more decks of cards, or offering games with worse rules to destroy the advantage gained by counting—even though these all negatively impact the non-counter as well.[1]

The group of four players, a professional gambler, and an investor who put up most of their capital ($5,000), went to Atlantic City in late December. They recruited more MIT students as players at the January blackjack class. They played intermittently through May 1980 and increased their capital four-fold, but were nonetheless more like a loose group sharing capital than a team with consistent strategies and quality control.

'Mr. M' meets Bill Kaplan[edit]

In May 1980, J. P. Massar, known as 'Mr. M' in the History Channel documentary, overheard a conversation about professional blackjack at a Chinese restaurant in Cambridge. He introduced himself to the speaker, Bill Kaplan, a 1980 Harvard MBA graduate who had run a successful blackjack team in Las Vegas three years earlier. Kaplan had earned his BA at Harvard in 1977 and delayed his admission to Harvard Business School for a year, when he moved to Las Vegas and formed a team of blackjack players using his own research and statistical analysis of the game. Using funds he received on graduation as Harvard's outstanding scholar-athlete, Kaplan generated more than a 35 fold rate of return in fewer than nine months of play.[2]

Kaplan continued to run his Las Vegas blackjack team as a sideline while attending Harvard Business School but, by the time of his graduation in May 1980, the players were so 'burnt out' in Nevada they were forced to hit the international circuit. Not feeling he could continue to manage the team successfully while they traveled throughout Europe and elsewhere, encountering different rules, playing conditions, and casino practices, Kaplan parted ways with his teammates, who then splintered into multiple small playing teams in pursuit of more favorable conditions throughout the world.

Kaplan observes Massar and friends in action[edit]

Mit Blackjack Team Wikipedia Shqip

After meeting Kaplan and hearing about his blackjack successes, Massar asked Kaplan if he was interested in going with a few of Massar's blackjack-playing friends to Atlantic City to observe their play. Given the fortuitous timing (Kaplan's parting with his Las Vegas team), he agreed to go in the hopes of putting together a new local team that he could train and manage.

Kaplan observed Massar and his teammates playing for a weekend in Atlantic City. He noted that each of the players used a different, and overcomplicated, card counting strategy. This resulted in error rates that undermined the benefits of the more complicated strategies. Upon returning to Cambridge, Kaplan detailed the problems he observed to Massar.

Kaplan capitalizes a new team[edit]

Kaplan said he would back a team but it had to be run as a business with formal management procedures, a required counting and betting system, strict training and player approval processes, and careful tracking of all casino play. A couple of the players were initially averse to the idea. They had no interest in having to learn a new playing system, being put through 'trial by fire' checkout procedures before being approved to play, being supervised in the casinos, or having to fill out detailed player sheets (such as casino, cash in and cash out totals, time period, betting strategy and limits, and the rest) for every playing session. However, their keen interest in the game coupled with Kaplan's successful track record won out.

The newly capitalised 'bank' of the MIT Blackjack Team started on 1 August 1980. The investment stake was $89,000, with both outside investors and players putting up the capital. Ten players, including Kaplan, Massar, Jonathan, Goose, and 'Big Dave' (aka 'coach', to distinguish from the Dave in the first round) played on this bank. Ten weeks later they more than doubled the original stake. Profits per hour played at the tables were $162.50, statistically equivalent to the projected rate of $170/hour detailed in the investor offering prospectus. Per the terms of the investment offering, players and investors split the profits with players paid in proportion to their playing hours and computer simulated win rates. Over the ten-week period of this first bank, players, mostly undergraduates, earned an average of over $80/hour while investors achieved an annualized return in excess of 250%.

Strategy and techniques[edit]

The team often recruited students through flyers and the players' friends from college campuses across the country. The team tested potential members to find out if they were suitable candidates and, if they were, the team thoroughly trained the new members for free. Fully trained players had to pass an intense 'trial by fire,' consisting of playing through 8 six-deck shoes with almost perfect play, and then undergo further training, supervision, and similar check-outs in actual casino play until they could become full stakes players.

The group combined individual play with a team approach of counters and big players to maximize opportunities and disguise the betting patterns that card counting produces. In a 2002 interview in Blackjack Forum magazine,[3] John Chang, an MIT undergrad who joined the team in late 1980 (and became MIT team co-manager in the mid-1980s and 1990s), reported that, in addition to classic card counting and blackjack team techniques, at various times the group used advanced shuffle and ace tracking techniques. While the MIT team's card counting techniques can give players an overall edge of about 2 percent, some of the MIT team's methods have been established as gaining players an overall edge of about 4 percent.[citation needed] In his interview, Chang reported that the MIT team had difficulty attaining such edges in actual play, and their overall results had been best with straight card counting.

The MIT Team's approach was originally developed by Al Francesco, elected by professional gamblers as one of the original seven inductees into the Blackjack Hall of Fame. Blackjack team play was first written about by Ken Uston, an early member of Al Francesco's teams. Uston's book on blackjack team play, Million Dollar Blackjack, was published shortly before the founding of the first MIT team. Kaplan enhanced Francesco's team methods and used them for the MIT team. The team concept enabled players and investors to leverage both their time and money, reducing their 'risk of ruin' while also making it more difficult for casinos to detect card counting at their tables.

Team history 1980–1990[edit]

The MIT Blackjack Team continued to play throughout the 1980s, growing to as many as 35 players in 1984 with a capitalization of as much as $350,000. Having played and run successful teams since 1977, Kaplan reached a point in late 1984 where he could not show his face in any casino without being followed by the casino personnel in search of his team members. As a consequence he decided to fall back on his growing real estate investment and development company, his 'day job' since 1980, and stopped managing the team. He continued for another year or so as an occasional player and investor in the team, now being run by Massar, Chang and Bill Rubin, a player who joined the team in 1984.

The MIT Blackjack Team ran at least 22 partnerships in the time period from late 1979 through 1989. At least 70 people played on the team in some capacity (either as counters, Big Players, or in various supporting roles) over that time span. Every partnership was profitable during this time period, after paying all expenses as well as the players' and managers' share of the winnings, with returns to investors ranging from 4%/year to over 300%/year.

Strategic Investments 1992–1993[edit]

In 1992, Bill Kaplan, J.P. Massar, and John Chang decided to capitalize on the opening of Foxwoods Casino in nearby Connecticut, where they planned to train new players. Acting as the General Partner, they formed a Massachusetts Limited Partnership in June 1992 called Strategic Investments to bankroll the new team. Structured similar to the numerous real estate development limited partnerships that Kaplan had formed, the limited partnership raised a million dollars, significantly more money than any of their previous teams, with a method based on Edward Thorp's high low system. It involved three players: a big player, a controller, and a spotter. The spotter checked when the deck went positive with card counting, the controller would bet small constantly, wasting money, and verifying the spotter's count. Once the controller found a positive, he would signal to the big player. He would make a massive bet, and win big. Confident with this new funding, the three general partners ramped up their recruitment and training efforts to capitalize on the opportunity.

Over the next two years, the MIT Team grew to nearly 80 players, including groups and players in Cambridge, New York, New Jersey, Pennsylvania, California, Illinois, and Washington. Sarah McCord, who joined the team in 1983 as an MIT student and later moved to California, was added as a partner soon after SI was formed and became responsible for training and recruitment of West Coast players.

At various times, there were nearly 30 players playing simultaneously at different casinos around the world, including Native American casinos throughout the country, Las Vegas, Atlantic City, Canada, and island locations. Never before had casinos throughout the world seen such an organized and scientific onslaught directed at the game. While the profits rolled in, so did the 'heat' from the casinos, and many MIT Team members were identified and barred. These members were replaced by fresh players from MIT, Harvard, and other colleges and companies, and play continued. Eventually, investigators hired by casinos realized that many of those they had banned had addresses in or near Cambridge, and the connection to MIT and a formalized team became clear. The detectives obtained copies of recent MIT yearbooks and added photographs from it to their image database.

With its leading players banned from most casinos and other more lucrative investment opportunities opening up at the end of the recession, Strategic Investments paid out its substantial earnings to players and investors and dissolved its partnership on December 31, 1993.

1994 and forward[edit]

After the dissolution of Strategic Investments, a few of the players took their winnings and split off into two independent groups. The Amphibians were primarily led by Semyon Dukach, with Dukach as the big player, Katie Lilienkamp (a controller), and Andy Bloch (a spotter). The other team was the Reptiles, led by Mike Aponte, Manlio Lopez and Wes Atamian. These teams had various legal structures, and at times million dollar banks and 50+ players. By 2000 the 15+ year reign of the MIT Blackjack Teams came to an end as players drifted into other pursuits.

Mit Blackjack Team Wikipedia Free

Difference between slot and port. In 1999, a member of the Amphibians won at Max Rubin's 3rd Annual Blackjack Ball competition. The event was featured in an October 1999 Cigar Aficionado article, which said the winner earned the unofficial title 'Most Feared Man in the Casino Business'.[4]

In the media[edit]

Books[edit]

- A variety of stories about a few of the players from the MIT Blackjack Team formed the basis of The New York Times best-sellingBringing Down the House, written by Ben Mezrich. While originally marketed as nonfiction, Mezrich later admitted characters and stories in the book were mostly fictive and composites of players and stories he had heard about through hearsay. The private investigation firm referred to as Plymouth in Bringing Down the House was Griffin Investigations.[5]

- Mezrich wrote a follow-up book, Busting Vegas, which took even greater liberty with the actual happenings of the team. Many events in this book were at least partly based on incidents that occurred during the team's Strategic Investments era.[6]

- Jeffrey Ma wrote a book titled The House Advantage: Playing the Odds to Win Big in Business about his time on the 1994 MIT blackjack team.

- Nathaniel Tilton, a student of former MIT team captains Mike Aponte and Semyon Dukach, authored The Blackjack Life detailing his experiences playing and being trained by the MIT Blackjack Team players.[7]

Films[edit]

- The 2004 film The Last Casino is loosely based on this premise and features three students and a professor counting cards in Ontario and Quebec.[8]

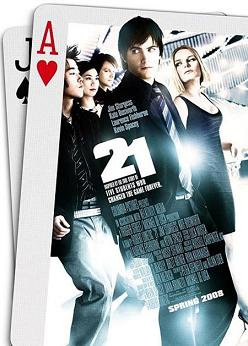

- The 2008 film 21, inspired by Bringing Down the House and produced by and starring Kevin Spacey and Jim Sturgess, was released on March 28, 2008 by Columbia Pictures. Jeff Ma and Henry Houh, former players on the team, appear in the movie as casino dealers, and Bill Kaplan appears in a cameo in the background of the underground Chinese gambling parlor scene. The script took significant artistic license with events, with most of its plot being invented for the movie, hence it refers to being 'inspired by true events' rather than 'based on true events.' One of the most significant departures from reality was the portrayal of the team being run by a professor (the Kevin Spacey character), when in reality the team was always run by students and alumni. The characters in the movie were also fictionalized amalgams of various players throughout the years of the team's existence - for example, the character Choi is very loosely (and inaccurately) based on Johnny Chang, and the character Ben Campbell, is an amalgam of numerous players, with the opening scene based on Big Dave's interview, and subsequent admission to Harvard Medical School, where much of the interview revolved around his participation on the team.

- The 2010 film Teen Patti is an uncredited remake of 21.

Television[edit]

- The Mysteries at the Museum series on the Travel Channel featured the story of the MIT Blackjack Team in the episode titled 'Siamese Twins, Assassin Umbrella, Capone's Cell'.

- The story of the MIT Blackjack Team, in its incarnation as Strategic Investments, was told in The History Channel documentary, Breaking Vegas, directed by Bruce David Klein.

- The Bringing Down The House period was featured on episodes of the Game Show Network documentary series, Anything to Win, and HBO's Real Sports with Bryant Gumbel (episode 116).

- The BBC documentary, Making Millions the Easy Way, addressed the Bringing Down the House period as part of the renowned 'Horizon' strand (directed by Johanna Gibbon), told the story of a Strategic Investments breakaway group, and revealed the science behind the winning formula.

- 'Double Down', an episode of Numb3rs concerned a counting group, led by a High School teacher, which launders money through casino winnings.

Other[edit]

The newly capitalised 'bank' of the MIT Blackjack Team started on 1 August 1980. The investment stake was $89,000, with both outside investors and players putting up the capital. Ten players, including Kaplan, Massar, Jonathan, Goose, and 'Big Dave' (aka 'coach', to distinguish from the Dave in the first round) played on this bank. Ten weeks later they more than doubled the original stake. Profits per hour played at the tables were $162.50, statistically equivalent to the projected rate of $170/hour detailed in the investor offering prospectus. Per the terms of the investment offering, players and investors split the profits with players paid in proportion to their playing hours and computer simulated win rates. Over the ten-week period of this first bank, players, mostly undergraduates, earned an average of over $80/hour while investors achieved an annualized return in excess of 250%.

Strategy and techniques[edit]

The team often recruited students through flyers and the players' friends from college campuses across the country. The team tested potential members to find out if they were suitable candidates and, if they were, the team thoroughly trained the new members for free. Fully trained players had to pass an intense 'trial by fire,' consisting of playing through 8 six-deck shoes with almost perfect play, and then undergo further training, supervision, and similar check-outs in actual casino play until they could become full stakes players.

The group combined individual play with a team approach of counters and big players to maximize opportunities and disguise the betting patterns that card counting produces. In a 2002 interview in Blackjack Forum magazine,[3] John Chang, an MIT undergrad who joined the team in late 1980 (and became MIT team co-manager in the mid-1980s and 1990s), reported that, in addition to classic card counting and blackjack team techniques, at various times the group used advanced shuffle and ace tracking techniques. While the MIT team's card counting techniques can give players an overall edge of about 2 percent, some of the MIT team's methods have been established as gaining players an overall edge of about 4 percent.[citation needed] In his interview, Chang reported that the MIT team had difficulty attaining such edges in actual play, and their overall results had been best with straight card counting.

The MIT Team's approach was originally developed by Al Francesco, elected by professional gamblers as one of the original seven inductees into the Blackjack Hall of Fame. Blackjack team play was first written about by Ken Uston, an early member of Al Francesco's teams. Uston's book on blackjack team play, Million Dollar Blackjack, was published shortly before the founding of the first MIT team. Kaplan enhanced Francesco's team methods and used them for the MIT team. The team concept enabled players and investors to leverage both their time and money, reducing their 'risk of ruin' while also making it more difficult for casinos to detect card counting at their tables.

Team history 1980–1990[edit]

The MIT Blackjack Team continued to play throughout the 1980s, growing to as many as 35 players in 1984 with a capitalization of as much as $350,000. Having played and run successful teams since 1977, Kaplan reached a point in late 1984 where he could not show his face in any casino without being followed by the casino personnel in search of his team members. As a consequence he decided to fall back on his growing real estate investment and development company, his 'day job' since 1980, and stopped managing the team. He continued for another year or so as an occasional player and investor in the team, now being run by Massar, Chang and Bill Rubin, a player who joined the team in 1984.

The MIT Blackjack Team ran at least 22 partnerships in the time period from late 1979 through 1989. At least 70 people played on the team in some capacity (either as counters, Big Players, or in various supporting roles) over that time span. Every partnership was profitable during this time period, after paying all expenses as well as the players' and managers' share of the winnings, with returns to investors ranging from 4%/year to over 300%/year.

Strategic Investments 1992–1993[edit]

In 1992, Bill Kaplan, J.P. Massar, and John Chang decided to capitalize on the opening of Foxwoods Casino in nearby Connecticut, where they planned to train new players. Acting as the General Partner, they formed a Massachusetts Limited Partnership in June 1992 called Strategic Investments to bankroll the new team. Structured similar to the numerous real estate development limited partnerships that Kaplan had formed, the limited partnership raised a million dollars, significantly more money than any of their previous teams, with a method based on Edward Thorp's high low system. It involved three players: a big player, a controller, and a spotter. The spotter checked when the deck went positive with card counting, the controller would bet small constantly, wasting money, and verifying the spotter's count. Once the controller found a positive, he would signal to the big player. He would make a massive bet, and win big. Confident with this new funding, the three general partners ramped up their recruitment and training efforts to capitalize on the opportunity.

Over the next two years, the MIT Team grew to nearly 80 players, including groups and players in Cambridge, New York, New Jersey, Pennsylvania, California, Illinois, and Washington. Sarah McCord, who joined the team in 1983 as an MIT student and later moved to California, was added as a partner soon after SI was formed and became responsible for training and recruitment of West Coast players.

At various times, there were nearly 30 players playing simultaneously at different casinos around the world, including Native American casinos throughout the country, Las Vegas, Atlantic City, Canada, and island locations. Never before had casinos throughout the world seen such an organized and scientific onslaught directed at the game. While the profits rolled in, so did the 'heat' from the casinos, and many MIT Team members were identified and barred. These members were replaced by fresh players from MIT, Harvard, and other colleges and companies, and play continued. Eventually, investigators hired by casinos realized that many of those they had banned had addresses in or near Cambridge, and the connection to MIT and a formalized team became clear. The detectives obtained copies of recent MIT yearbooks and added photographs from it to their image database.

With its leading players banned from most casinos and other more lucrative investment opportunities opening up at the end of the recession, Strategic Investments paid out its substantial earnings to players and investors and dissolved its partnership on December 31, 1993.

1994 and forward[edit]

After the dissolution of Strategic Investments, a few of the players took their winnings and split off into two independent groups. The Amphibians were primarily led by Semyon Dukach, with Dukach as the big player, Katie Lilienkamp (a controller), and Andy Bloch (a spotter). The other team was the Reptiles, led by Mike Aponte, Manlio Lopez and Wes Atamian. These teams had various legal structures, and at times million dollar banks and 50+ players. By 2000 the 15+ year reign of the MIT Blackjack Teams came to an end as players drifted into other pursuits.

Mit Blackjack Team Wikipedia Free

Difference between slot and port. In 1999, a member of the Amphibians won at Max Rubin's 3rd Annual Blackjack Ball competition. The event was featured in an October 1999 Cigar Aficionado article, which said the winner earned the unofficial title 'Most Feared Man in the Casino Business'.[4]

In the media[edit]

Books[edit]

- A variety of stories about a few of the players from the MIT Blackjack Team formed the basis of The New York Times best-sellingBringing Down the House, written by Ben Mezrich. While originally marketed as nonfiction, Mezrich later admitted characters and stories in the book were mostly fictive and composites of players and stories he had heard about through hearsay. The private investigation firm referred to as Plymouth in Bringing Down the House was Griffin Investigations.[5]

- Mezrich wrote a follow-up book, Busting Vegas, which took even greater liberty with the actual happenings of the team. Many events in this book were at least partly based on incidents that occurred during the team's Strategic Investments era.[6]

- Jeffrey Ma wrote a book titled The House Advantage: Playing the Odds to Win Big in Business about his time on the 1994 MIT blackjack team.

- Nathaniel Tilton, a student of former MIT team captains Mike Aponte and Semyon Dukach, authored The Blackjack Life detailing his experiences playing and being trained by the MIT Blackjack Team players.[7]

Films[edit]

- The 2004 film The Last Casino is loosely based on this premise and features three students and a professor counting cards in Ontario and Quebec.[8]

- The 2008 film 21, inspired by Bringing Down the House and produced by and starring Kevin Spacey and Jim Sturgess, was released on March 28, 2008 by Columbia Pictures. Jeff Ma and Henry Houh, former players on the team, appear in the movie as casino dealers, and Bill Kaplan appears in a cameo in the background of the underground Chinese gambling parlor scene. The script took significant artistic license with events, with most of its plot being invented for the movie, hence it refers to being 'inspired by true events' rather than 'based on true events.' One of the most significant departures from reality was the portrayal of the team being run by a professor (the Kevin Spacey character), when in reality the team was always run by students and alumni. The characters in the movie were also fictionalized amalgams of various players throughout the years of the team's existence - for example, the character Choi is very loosely (and inaccurately) based on Johnny Chang, and the character Ben Campbell, is an amalgam of numerous players, with the opening scene based on Big Dave's interview, and subsequent admission to Harvard Medical School, where much of the interview revolved around his participation on the team.

- The 2010 film Teen Patti is an uncredited remake of 21.

Television[edit]

- The Mysteries at the Museum series on the Travel Channel featured the story of the MIT Blackjack Team in the episode titled 'Siamese Twins, Assassin Umbrella, Capone's Cell'.

- The story of the MIT Blackjack Team, in its incarnation as Strategic Investments, was told in The History Channel documentary, Breaking Vegas, directed by Bruce David Klein.

- The Bringing Down The House period was featured on episodes of the Game Show Network documentary series, Anything to Win, and HBO's Real Sports with Bryant Gumbel (episode 116).

- The BBC documentary, Making Millions the Easy Way, addressed the Bringing Down the House period as part of the renowned 'Horizon' strand (directed by Johanna Gibbon), told the story of a Strategic Investments breakaway group, and revealed the science behind the winning formula.

- 'Double Down', an episode of Numb3rs concerned a counting group, led by a High School teacher, which launders money through casino winnings.

Other[edit]

Several members of the two teams have used their expertise to start public speaking careers as well as businesses teaching others how to count cards. For example:

- Mike Aponte of the Reptiles co-founded a company with former MIT Blackjack Team member David Irvine called the Blackjack Institute.

- Semyon Dukach of the Amphibians founded Blackjack Science.

References[edit]

- ^Griffin, Peter A. (1979). The Theory of Blackjack. Huntington Press. ISBN0-915141-02-7.

- ^'How a team of students beat the casinos'. BBC.com. Retrieved 26 May 2014.

- ^Blackjack Forum interview with Johnny Chang

- ^The Twenty One Club: The annual blackjack ball hosts Gambling's Most Furtive (and Quirky) FraternityArchived 2009-04-20 at the Wayback Machine cigaraficionado.com, Sept/Oct 1999

- ^Ian Kaplan (March 2004). 'review of Bringing Down the House'.

- ^ThePOGG (10 November 2012). 'ThePOGG Interviews – Semyon Dukach – MIT Card Counting team captain'.

- ^'ThePOGG Interviews – Nathaniel Tilton author of 'The Blackjack Life''. Retrieved 6 March 2013.

- ^The Last Casino on IMDb.Retrieved 2009-11-03.

External links[edit]

SolidWorks 2012 displaying a 3D part in multiple views. | |

| Developer(s) | Dassault Systèmes SolidWorks Corp. |

|---|---|

| Initial release | November1, 1995[1] |

| Stable release | |

| Operating system | Microsoft Windows |

| Available in | English |

| Type | CAD and CAE |

| License | Proprietary |

| Website | www.solidworks.com |

SolidWorks (stylized as SOLIDWORKS) is a solid modelingcomputer-aided design (CAD) and computer-aided engineering (CAE) computer program that runs on Microsoft Windows. SolidWorks is published by Dassault Systèmes.

According to the publisher, over two million engineers and designers at more than 165,000 companies were using SolidWorks as of 2013.[2] Also according to the company, fiscal year 2011–12 revenue for SolidWorks totalled $483 million.[3]

History

SolidWorks Corporation was founded in December 1993 by Massachusetts Institute of Technology graduate Jon Hirschtick. Hirschtick used $1 million he had made while a member of the MIT Blackjack Team to set up the company.[4] Initially based in Waltham, Massachusetts, United States, Hirschtick recruited a team of engineers with the goal of building 3D CAD software that was easy-to-use, affordable, and available on the Windows desktop. Operating later from Concord, Massachusetts, SolidWorks released its first product SolidWorks 95, in November 1995.[5][6] In 1997 Dassault, best known for its CATIA CAD software, acquired SolidWorks for $310 million in stock.[5] Jon Hirschtick stayed on board for the next 14 years in various roles. Under his leadership, SolidWorks grew to a $100 million revenue company.[7]

SolidWorks currently markets several versions of the SolidWorks CAD software in addition to eDrawings, a collaboration tool, and DraftSight, a 2D CAD product.

SolidWorks was headed by John McEleney from 2001 to July 2007 and Jeff Ray from 2007 to January 2011. The current CEO is Gian Paolo Bassi from Jan 2015. Gian Paolo Bassi replaces Bertrand Sicot, who is promoted Vice President Sales of Dassault Systèmes' Value Solutions sales channel.

Release history

| Name/Version | Version History Value | Release Date |

|---|---|---|

| SolidWorks 95 | 46 | November 1995[1] |

| SolidWorks 96 | 270 | Early 1996 |

| SolidWorks 97 | 483 | Late 1996 |

| SolidWorks 97Plus | 629 | 1997 |

| SolidWorks 98 | 817 | 1997 |

| SolidWorks 98Plus | 1008 | 1998 |

| SolidWorks 99 | 1137 | 1998 |

| SolidWorks 2000 | 1500 | 1999 |

| SolidWorks 2001 | 1750 | 2000 |

| SolidWorks 2001Plus | 1950 | 2001 |

| SolidWorks 2003 | 2200 | 2002 |

| SolidWorks 2004 | 2500 | 2003 |

| SolidWorks 2005 | 2800 | 2004 |

| SolidWorks 2006 | 3100 | 2005 |

| SolidWorks 2007 | 3400 | 2006 |

| SolidWorks 2008 | 3800 | July 1, 2007 |

| SolidWorks 2009 | 4100 | January 28, 2008 |

| SolidWorks 2010 | 4400 | December 9, 2009 |

| SolidWorks 2011 | 4700 | June 17, 2010 |

| SolidWorks 2012 | 5000 | September, 2011 |

| SolidWorks 2013 | 6000 | September, 2012 |

| SolidWorks 2014 | 7000 | October 7, 2013 |

| SolidWorks 2015 | 8000 | September 9, 2014 |

| SolidWorks 2016 | 9000 | October 1, 2015 |

| SolidWorks 2017 | 10000 | September 19, 2016 |

Market

DS Solidworks Corp. Casino near modesto california. has sold over 1.5 million licenses of SolidWorks worldwide.[8] This includes a large proportion of educational licenses.[9] The Sheffield Telegraph comments that Solidworks is the world's most popular CAD software.[10] Its user base ranges from individuals to large corporations, and covers a very wide cross-section of manufacturing market segments. Commercial sales are made through an indirect channel, which includes dealers and partners throughout the world. In the United States, the first reseller of SolidWorks, in 1995, was Computer Aided Technology, Inc, headquartered in Chicago. Directly competitive products to SolidWorks include Solid Edge, and Autodesk Inventor. SolidWorks also partners with third party developers to add functionality in niche market applications like finite element analysis, circuit layout, tolerance checking, etc. SolidWorks has also licensed its 3D modeling capabilities to other CAD software vendors, notably ANVIL.[11]

Modeling technology

SolidWorks is a solid modeler, and utilizes a parametric feature-based approach to create models and assemblies. The software is written on Parasolid-kernel.

Parameters refer to constraints whose values determine the shape or geometry of the model or assembly. Parameters can be either numeric parameters, such as line lengths or circle diameters, or geometric parameters, such as tangent, parallel, concentric, horizontal or vertical, etc. Numeric parameters can be associated with each other through the use of relations, which allows them to capture design intent.

Design intent is how the creator of the part wants it to respond to changes and updates. For example, you would want the hole at the top of a beverage can to stay at the top surface, regardless of the height or size of the can. SolidWorks allows the user to specify that the hole is a feature on the top surface, and will then honor their design intent no matter what height they later assign to the can.

Features refer to the building blocks of the part. They are the shapes and operations that construct the part. Shape-based features typically begin with a 2D or 3D sketch of shapes such as bosses, holes, slots, etc. This shape is then extruded or cut to add or remove material from the part. Operation-based features are not sketch-based, and include features such as fillets, chamfers, shells, applying draft to the faces of a part, etc.

Building a model in SolidWorks usually starts with a 2D sketch (although 3D sketches are available for power users). The sketch consists of geometry such as points, lines, arcs, conics (except the hyperbola), and splines. Dimensions are added to the sketch to define the size and location of the geometry. Relations are used to define attributes such as tangency, parallelism, perpendicularity, and concentricity. The parametric nature of SolidWorks means that the dimensions and relations drive the geometry, not the other way around. The dimensions in the sketch can be controlled independently, or by relationships to other parameters inside or outside of the sketch.

In an assembly, the analog to sketch relations are mates. Just as sketch relations define conditions such as tangency, parallelism, and concentricity with respect to sketch geometry, assembly mates define equivalent relations with respect to the individual parts or components, allowing the easy construction of assemblies. SolidWorks also includes additional advanced mating features such as gear and cam follower mates, which allow modeled gear assemblies to accurately reproduce the rotational movement of an actual gear train.

Finally, drawings can be created either from parts or assemblies. Views are automatically generated from the solid model, and notes, dimensions and tolerances can then be easily added to the drawing as needed. The drawing module includes most paper sizes and standards (ANSI, ISO, DIN, GOST, JIS, BSI and SAC).

File format

SolidWorks files (previous to version 2015) use the Microsoft Structured Storage file format. This means that there are various files embedded within each SLDDRW (drawing files), SLDPRT (part files), SLDASM (assembly files) file, including preview bitmaps and metadata sub-files. Various third-party tools (see COM Structured Storage) can be used to extract these sub-files, although the subfiles in many cases use proprietary binary file formats.

See also

References

- 'The future of Solidworks'. September 27, 2011. Retrieved May 6, 2016.

- ↑ Opening statement by CEO Bertrand Sicot at 2013 Solidworks World YouTube Video Link.

- ↑ SolidWorks Fact Sheet, July 30, 2012.

- ↑ Bob Tremblay (March 26, 2008). 'Former MIT blackjack team member talks about breaking the bank'. Galesburg Register News.

- Solidworks Company History. Solidworks company website

- ↑ Solidworks Company Information, Solidworks company website

- ↑ 'Exclusive: SolidWorks vets raise $64 million for Onshape'.

- ↑ 'Thanks for helping us reach our millionth license!'. SolidWorks. April 30, 2009. Retrieved 2009-07-12.

- ↑ http://cadworkstations.strikingly.com/blog/solidworks-in-u-s-universities

- ↑ 'Solid finds solution in business park switch'. The Sheffield Telegraph. December 10, 2009. Retrieved 2010-02-15.

- ↑ 'ANVIL EXPRESS® SOLIDWORKS® Connectivity'. MCS ANVIL. September 2009. Retrieved 2011-04-15.

External links

| Wikimedia Commons has media related to SolidWorks. |

| People |

|---|

| Brands |

| Products |

| Related |

| Free and open-source |

| |||

|---|---|---|---|---|

| Proprietary |

| |||

| File formats | ||||

| Modeling kernels |

| Open Source |

|

|---|---|

| Proprietary | |

| Cloud Based |